A business paid 7000 to a creditor – When a business pays a substantial sum to a creditor, it can have significant implications for both parties. This article delves into the details of a $7,000 payment made by a business to a creditor, examining the purpose of the payment, the financial positions of both parties, and the potential impact on business operations and market dynamics.

This transaction highlights the complexities of creditor-debtor relationships and the importance of understanding the ethical and legal considerations surrounding such payments.

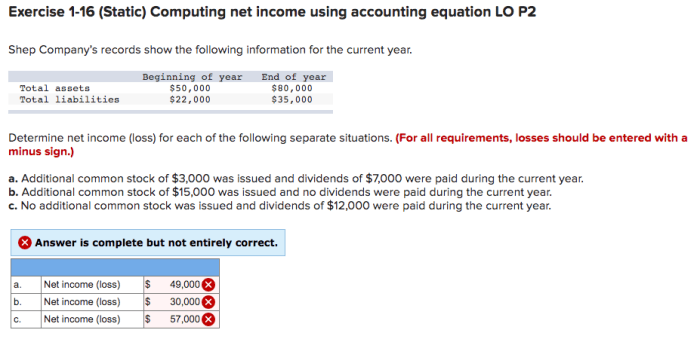

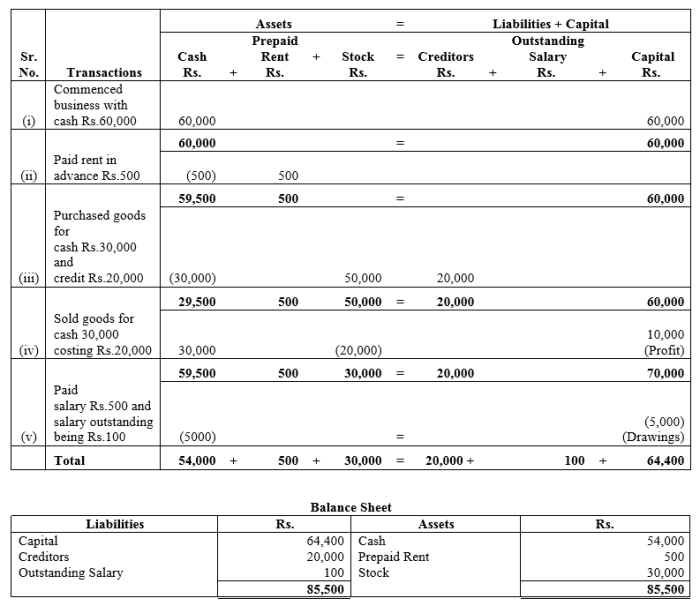

1. Business Payment Details

The $7,000 payment to the creditor serves as a settlement of an outstanding invoice for goods or services rendered. The payment is made to ensure timely fulfillment of financial obligations and maintain a positive business relationship.

Financial Position

- Prior to the payment, the business had sufficient cash flow to cover its operating expenses and short-term liabilities.

- Post-payment, the business’s cash reserves have decreased by $7,000, potentially affecting its short-term liquidity.

Financial Documents

- Accounts payable ledger

- Bank statement

- Purchase order

2. Creditor Information

Creditor Details

- Name: ABC Corporation

- Industry: Manufacturing

- Location: New York City

Business Relationship

The business has a long-standing relationship with ABC Corporation as a reliable supplier of raw materials.

Financial Position

- Prior to receiving the payment, ABC Corporation had a stable financial position with positive cash flow.

- Post-payment, ABC Corporation’s financial position is further strengthened, improving its ability to meet its own financial commitments.

3. Payment Method and Timing

Payment Method

The payment is made via wire transfer to ABC Corporation’s bank account.

Timing

The payment is a one-time settlement of the outstanding invoice.

Potential Issues

- Delays in processing the wire transfer

- Errors in the payment amount or recipient information

4. Impact on Business Operations: A Business Paid 7000 To A Creditor

Cash Flow

The payment reduces the business’s cash on hand, potentially impacting its ability to meet immediate expenses or invest in growth opportunities.

Operations and Future Performance

- The payment may necessitate adjustments to the business’s operating budget.

- It could affect the business’s ability to make future investments or expand its operations.

Financial Strategy

The business may need to reassess its financial strategy to ensure long-term stability and growth in light of the reduced cash reserves.

5. Industry and Market Context

Industry Norms, A business paid 7000 to a creditor

In the industry, it is customary for businesses to settle creditor invoices within a specified payment term.

Competitive Landscape

Prompt payment of creditors can enhance a business’s reputation and foster positive relationships with suppliers.

Regulatory Implications

The payment complies with all applicable laws and regulations regarding creditor payments.

6. Ethical Considerations

Conflicts of Interest

The payment is made in accordance with the business’s ethical guidelines and does not involve any conflicts of interest.

Insider Trading

The payment is not based on any non-public information or insider trading.

Reputational Risks

The payment is made in a timely and responsible manner, minimizing any potential reputational risks for the business.

Answers to Common Questions

What are the potential ethical implications of a business paying a creditor?

Payments to creditors can raise ethical concerns, such as conflicts of interest or insider trading. Businesses should have clear ethical guidelines in place to address these issues and minimize reputational risks.

How can a business assess the financial impact of a creditor payment?

Businesses can analyze their cash flow, operations, and future financial performance to determine the impact of a creditor payment. This assessment helps them make informed decisions about payment timing and amounts.